Introduction: ECB expected to cut interest rates today

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

Interest rates across the eurozone are likely to be cut today, as the European Central Bank attempts to support the euro economy as it reels from the damage caused by Donald Trump’s trade wars.

The ECB is widely expected to cut its key interest rates by a quarter of one percentage point. That would lower its deposit facility rate to 2%, and would be the eighth cut in a year.

A cut looks nailed on, after inflation across the eurozone fell to 1.9% last month, below the ECB’s 2% target for the first time since last September.

Markets are pricing almost a 100% probability of a quarter-point cut, reports Ronald Temple, chief market strategist at Lazard Asset Management, adding:

With ongoing declines in inflation and consistently dovish language from ECB members, a rate cut appears to be a done deal. The ECB has previously described 1.75%–2.25% as the range that would be considered neutral monetary policy. Any signals of a change in this view would be surprising.

I continue to expect rates to be reduced to 1.5% by year end given a more aggressive US trade posture against the European Union. Markets suggest a slightly less dovish outlook with rates ending the year just below 1.6%.”

Today, investors will also be interested to hear the ECB’s latest forecasts – economists expect cuts to its growth and inflation projections for next year.

The ECB may also signal that it could pause its rate cutting cycle over the summer, before reassessing the situation in September.

Christine Lagarde can also expect questions about her claim last month that the euro could take on a more global role, as the dollar loses influence amid the current trade turmoil.

Lagarde’s future could also come up, following claims that she has discussed cutting short her term as European Central Bank president to become chair of the World Economic Forum.

The agenda

-

7am: German factory orders for April

-

9am BST: UK new car sales report for May

-

9.30am BST: UK construction PMI report

-

1.15pm BST: European Central Bank interest rate decision

-

1.30pm BST: US trade data for April

-

1.30pm BST: US weekly jobless claims data

-

1.45pm BST: European Central Bank press conference

Key events Show key events only Please turn on JavaScript to use this feature

Wizz Air shares tumble after plane groundings hit profits

Budget airline Wizz Air has reported a plunge in profits, after almost a fiifth of its fleet were grounded last year due to engine problems.

Wizz Air’s shares have dropped by 24% this morning, after it reported that operating profits fell by 61% to €167.5m in the last financial year.

Wizz says it was “a year of significant challenges”, as an average of 44 aircraft were parked during the year, owing to issues with Pratt & Whitney’s Geared Turbofan (GTF) engines, which power many of its Airbus A320NEO planes.

József Váradi, Wizz Air’s CEO, says:

“I describe our fiscal year F25 with two words: resilience and transformation.

In an environment where rare challenges have become recurrent, Wizz Air has evolved structurally, embedding increased flexibility into our standard operating model. While often dismissed as ‘easier said than done,’ the past year’s events tested both our company and management. We emerged stronger, wiser, and better prepared.”

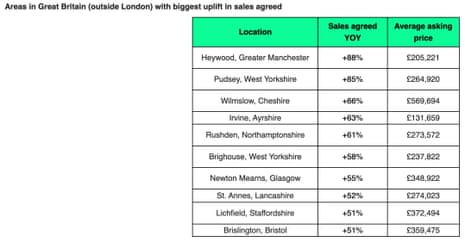

May was the busiest month for UK house sales since March 2022, new data from Rightmove this morning shows.

Across Great Britain, the number of sales agreed is now 6% ahead of the same period last year, Rightmove reports. But London is lagging, with sales just 1% higher than a year ago.

May is typically a busy month in the year for agreed sales, and last month’s was the busiest May since 2021.

Rightmove argues that May’s data suggests market conditions have improved, as home-movers carry on following the stamp duty increase at the start of April.

UK fintech Wise to switch main stock market listing to New York

UK fintech Wise has joined the ranks of companies looking to migrate to the US stock markets.

Wise, which floated in London less than four years ago, told shareholders this morning that it plans to switch its primary listing to New York, the latest blow to the London market.

Wise’s CEO, Kristo Käärmann, told the City:

As part of our next step on that journey, today we are announcing our intention to dual list our shares in the US and UK. We believe the addition of a primary US listing would help us accelerate our mission and bring substantial strategic and capital market benefits to Wise and our Owners.

These include helping us drive greater awareness of Wise in the US, the biggest market opportunity in the world for our products today, and enabling better access to the world’s deepest and most liquid capital market.

Wise was formerly known as TransferWise, which became the largest tech listing in the UK when it was valued at nearly £9bn after its 2021 stock market debut.

Käärmann adds that Wise plans to maintain a secondary listing on the London stock exchange, saying:

“A dual listing would also enable us to continue serving our UK-based Owners effectively, as part of our ongoing commitment to the UK. The UK is home to some of the best talent in the world in financial services and technology, and we will continue to invest in our presence here to fuel our UK and global growth.”

Several other UK-listed companies have recently shifted their listing to New York, including construction rental company Ashtead Group, and gambling giant Flutter.

German factory orders rise unexpectedly

German factory orders have jumped unexpectedly, defying forecasts that they would fall as Donald Trump’s tariffs disrupted trade.

Orders at German manufacturers rose by 0.6% in April, official data this morning shows, beating forecasts of a 1% fall.

Statistics body Destatis also reported that foreign orders declined by 0.3%, despite a 0.5% rise in orders from within the eurozone. Domestic orders increased by 2.2%.

Demand for data processing equipment, electronic, and optical products increased, while there was also a rise in new orders for transport equipment, and for metal products.

Introduction: ECB expected to cut interest rates today

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

Interest rates across the eurozone are likely to be cut today, as the European Central Bank attempts to support the euro economy as it reels from the damage caused by Donald Trump’s trade wars.

The ECB is widely expected to cut its key interest rates by a quarter of one percentage point. That would lower its deposit facility rate to 2%, and would be the eighth cut in a year.

A cut looks nailed on, after inflation across the eurozone fell to 1.9% last month, below the ECB’s 2% target for the first time since last September.

Markets are pricing almost a 100% probability of a quarter-point cut, reports Ronald Temple, chief market strategist at Lazard Asset Management, adding:

With ongoing declines in inflation and consistently dovish language from ECB members, a rate cut appears to be a done deal. The ECB has previously described 1.75%–2.25% as the range that would be considered neutral monetary policy. Any signals of a change in this view would be surprising.

I continue to expect rates to be reduced to 1.5% by year end given a more aggressive US trade posture against the European Union. Markets suggest a slightly less dovish outlook with rates ending the year just below 1.6%.”

Today, investors will also be interested to hear the ECB’s latest forecasts – economists expect cuts to its growth and inflation projections for next year.

The ECB may also signal that it could pause its rate cutting cycle over the summer, before reassessing the situation in September.

Christine Lagarde can also expect questions about her claim last month that the euro could take on a more global role, as the dollar loses influence amid the current trade turmoil.

Lagarde’s future could also come up, following claims that she has discussed cutting short her term as European Central Bank president to become chair of the World Economic Forum.

The agenda

-

7am: German factory orders for April

-

9am BST: UK new car sales report for May

-

9.30am BST: UK construction PMI report

-

1.15pm BST: European Central Bank interest rate decision

-

1.30pm BST: US trade data for April

-

1.30pm BST: US weekly jobless claims data

-

1.45pm BST: European Central Bank press conference

1 day ago

13

1 day ago

13