Company insolvencies in England and Wales fall

Just in: the number of companies in England and Wales falling into insolvency dropped last month.

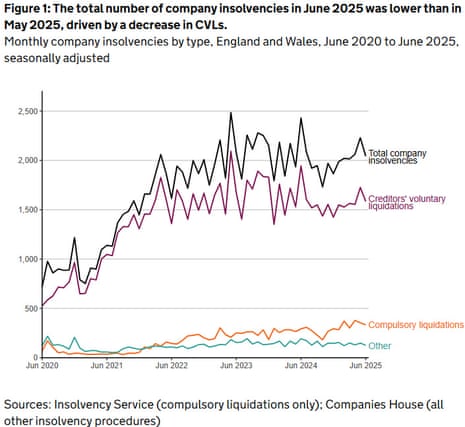

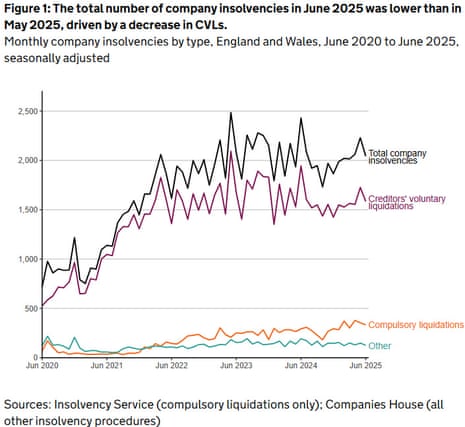

The Insolvency Service has reported that there were 2,043 registered company insolvencies in England and Wales in June, 8% lower than in May 2025 (2,230) and 16% lower than in June 2024, when 2,430 companies failed.

That could ease some concerns over the health of the UK economy, as companies tackle rising inflation and higher taxes.

Despite the drop, monthly company insolvency numbers in the first six months of 2025 were slightly higher than the second half of 2024, but remain lower than the 30-year annual high seen in 2023.

The Insolvency Service says:

Company insolvencies in June 2025 consisted of 332 compulsory liquidations, 1,585 creditors’ voluntary liquidations (CVLs), 111 administrations and 15 company voluntary arrangements (CVAs). There were no receivership appointments.

Key events Show key events only Please turn on JavaScript to use this feature

Ofwat to be abolished as ministers explore creating new water regulator

Helena Horton

Big news in the water industry: England and Wales’ embattled water regulator will be abolished under recommendations from a government-commissioned review due on Monday, the Guardian understands.

Ministers will next week announce a consultation into creating a new regulator, to coincide with the results of a review into the water industry directed by former Bank of England deputy governor Sir Jon Cunliffe.

This consultation is likely to conclude in the abolishment of Ofwat, the embattled watchdog that polices how much water companies can charge for their services in England and Wales, sources said.

Ofwat has faced intense criticism over its failure to prevent sewage spills, hefty payment of dividends and ballooning debts across England and Wales’s water companies. The review will recommend the creation of new regulatory system.

Festivalgoers help drive Burberry to best sales performance in 18 months

Back in the City, fashion group Burberry is one of the best performers on the London stock market today, after slowing its decline in sales.

Surprisingly, demand for Burberry wellies, scarves and light jackets to wear at music festivals have helped the fashion brand to its best sales performance in 18 months, my colleague Sarah Butler reports.

Sales of the luxury British brand fell by 2% to £433m in the three months to the end of June, with a 1% decline at established stores, an improvement from the 6% fall in the previous quarter and the best performance since Christmas 2023.

Shares in Burberry are up almost 5%, making it one of the top risers on the FTSE 250 share index.

One member of the Federal Reserve board, Christopher Waller, should be in president Trump’s good books, though.

Last night, Waller argued that the Fed should cut rates by the end of this month, and cited growing risks to the economy and (he argued) limited inflationary risks from trade tariffs.

Waller told a gathering of Money Marketeers of New York University:

“It makes sense to cut the FOMC’s policy rate by 25 basis points two weeks from now.

“I see the hard and soft data on economic activity and the labor market as consistent: The economy is still growing, but its momentum has slowed significantly, and the risks to the FOMC’s employment mandate have increased.”

The Fed’s next two-day meeting starts on 29 July, with a decision scheduled for the 30th.

Brad Bechtel of investment bank Jefferies says Waller’s speech is getting some attention, explaining:

Waller not typically a politically motivated character on the Fed, so his strong view on this matter is important in that context.

His main arguments are that 1) tariffs are a one-off price increase and not a consistent impact to inflation, 2) GDP is below trend and a little too soft, arguing for rates closer to neutral, 3) employment looks fine on the surface, but downside risks have increased and private sector payroll growth is near ‘stall speed’. He therefore thinks we should cut rates by a quarter this month.

Pretty strong view from Waller as the Fed gets close to entering their blackout period before the next meeting.

Trump: Powell was "truly one of my worst appointments", and blasts Fed board

Donald Trump has just declared that choosing Jerome Powell in 2017 to run the US Federal Reserve was one of his “worst” decisions, calling America’s top central banker a “numbskull” for not lowering borrowing costs.

Trump blames president Biden, who he dubs “Sleepy Joe”, for renominating Powell in 2021, and also blasts the Fed’s board for not lowering rates.

Posting on his Truth Social site, Trump again refers to Powell as “Too Late”, and again claims that US interest rates (currently a 4.25%-4.5% range) should be considerable lower, at just 1% (!).

Trump writes:

“Too Late,” and the Fed, are choking out the housing market with their high rate, making it difficult for people, especially the young, to buy a house. He is truly one of my worst appointments. Sleepy Joe saw how bad he was and reappointed him anyway - And the Fed Board has done nothing to stop this “numbskull” from hurting so many people. In many ways the Board is equally to blame! The USA is Rockin’, there is VERY LOW INFLATION, and we deserve to be at 1%, saving One Trillion Dollars a year on Interest Costs. I can’t tell you how dumb Too Late is - So bad for our Country!

Stock markets wobbled earlier this week following reports that Trump was preparing to fire Powell, but recovered when the president denied it.

The Fed’s board makes up a majority on the FOMC committee which vote to set US interest rates.

The FOMC have voted to leave interest rates on hold so far this year, partly due to concerns that Trump’s trade war will be inflationary.

The Insolvency Service has also reported that 10,279 individuals entered insolvency in England and Wales last month. This was similar to the numbers in both May 2025 and June 2024.

They explain:

The individual insolvencies consisted of 596 bankruptcies, 4,135 debt relief orders (DROs) and 5,548 individual voluntary arrangements (IVAs). The number of DROs in June 2025 was close to the record monthly high seen in June 2024.

IVA numbers in the first six months of 2025 were similar to the monthly average in 2024. Bankruptcy numbers remained at about half of pre-2020 levels and were also 10% lower than in June 2024.

Shares in Sweden’s fighter jet maker Saab have jumped 12% this morning, after the company announced strong sales growth amid the rush to spend more on defence.

Saab reported organic sales growth of 32% in the last quarter, driven by strong growth in small and medium-sized orders.

Micael Johansson, president and CEO of Saab, says:

“We are strengthening our market position and see a continued large interest in our products and solutions. Saab’s sales growth is high and we continue to invest to build capacity and meet long-term strong demand from the defence sector. At the same time, we continue to deliver strong profitability.”

Kroll: companies showing resilience in a 'tough' 2025

Risk advisory firm Kroll point out that 2025 has been challenging for many businesses, including in leisure and retail.

Benjamin Wiles, head of UK restructuring at Kroll:

“There’s no doubt that 2025 has been a tough year for businesses so far, particularly those in the retail and leisure industry. Yet, the overall decline in company administrations compared to this period last year shows a level of resilience that shouldn’t be overlooked. We saw a lot of restructuring activity at the end of last year with many companies looking to get ahead of cost pressures and there is still a lot of capital available to borrow.

“The question we are asking is whether businesses are fundamentally stronger or are they simply treading water. The second half of the year will be critical in determining whether this resilience can be sustained or if further pressures will tip more companies into distress.”

Kroll also produced this table, based on their internal data, which tracks administrations throughout the year.

Yesterday’s UK unemployment data showed that more than half the fall in payroll numbers over the last year was due to job losses in accommodation and food services.

The recent hot weather may have helped some hospitality firms and retailers avoid collapse, suggests Jennifer Lockhart, partner and insolvency specialist at purpose-led independent law firm Brabners.

Lockhart says:

A fall in insolvencies is welcome and reflects the positive impact that the warmer summer months can have on business performance – especially in the retail, construction and hospitality sectors that have borne the brunt of failures to date. However, amid these soaring temperatures it’s important to recognise that this likely represents a period of reprieve for businesses, rather than a turning point.

“Consumer confidence remains fragile, and the one-two punch of contracting GDP in May and growing inflation in June will do little to assuage concerns over what the next six months will hold for struggling businesses. Indeed, with many industries dialing back hiring plans – in part due to the influence of employment taxes and the impact of AI – the much-needed uptick in consumer demand is unlikely to materialize, putting more firms at risk.”

Fall in insolvencies 'offers a glimmer of relief'

Businesses are still in “tough” times, despite the drop in insolvencies in June, cautions David Hudson, restructuring advisory partner at FRP.

Hudson says:

“The slight fall in insolvencies this month offers a glimmer of relief – especially for hospitality and retail businesses, which are now reaping the benefits of record hot weather. However, we’re still in tough territory. Consumer confidence remains stubbornly low, growth is stuttering – with GDP dipping again in May. June’s unexpected jump in inflation will only serve to continue eroding profit margins and consumer demand.

“This environment is forcing businesses to fight on multiple fronts. Many will likely only be experiencing breathing space after dramatically paring back costs. Until demand shows a more sustained recovery and input costs ease further, there’s a risk that this reprieve is just a pause rather than a turning point.”

Company insolvencies in England and Wales fall

Just in: the number of companies in England and Wales falling into insolvency dropped last month.

The Insolvency Service has reported that there were 2,043 registered company insolvencies in England and Wales in June, 8% lower than in May 2025 (2,230) and 16% lower than in June 2024, when 2,430 companies failed.

That could ease some concerns over the health of the UK economy, as companies tackle rising inflation and higher taxes.

Despite the drop, monthly company insolvency numbers in the first six months of 2025 were slightly higher than the second half of 2024, but remain lower than the 30-year annual high seen in 2023.

The Insolvency Service says:

Company insolvencies in June 2025 consisted of 332 compulsory liquidations, 1,585 creditors’ voluntary liquidations (CVLs), 111 administrations and 15 company voluntary arrangements (CVAs). There were no receivership appointments.

Goldman: Bank of England rate cuts will take a little longer

Goldman Sachs has predicted the Bank of England will take a slightly slower approach to cutting interest rates, following this week’s data.

Goldman still expect a rate cut in August (from 4.25% to 4%), even though inflation rose in June and private sector pay growth in March-May was higher than expected.

But they have now dropped their forecast for a September cut.

Sven Jari Stehn, Goldman’s chief European economist, told clients:

While the hurdle for speeding up cuts in September looks higher after this week’s data, we now expect sequential cuts from November until reaching a 3% terminal rate in March 2026 (versus February before). That is, we now expect a total of five cuts this year (previously six) and two next year (previously one).

That would mean rate cuts in August, November and December this year, and February and March 2026.

The Bank has already cut rates twice this year, at its meetings in February and May.

Shares in pharmaceuticals firm GSK have dropped over 6% in early trading, after its blood cancer drug Blenrep hit a regulatory hurdle in the US.

Yesterday, the US FDA’s panel of independent advisers recommended against Blenrep, citing earlier concerns over eye-related side effects.

GSK told the City that it remains confident in the benefit/risk profile of Blenrep and said it will continue to work closely with the FDA as they complete their review of the drug. The final decision on whether to approve a drug rests with the FDA, which will consider the view of its Oncologic Drugs Advisory Committee (ODAC), which voted 5-3 against Blenrep.

The company added that Blenrep combinations are approved for refractory multiple myeloma (cancer that does not respond to treatment) in several markets including the UK and Japan, and that applications in other markets including the EU and China are being reviewed.

EU approves new Russian sanctions package

The European Union has announced the approval of a fresh sanctions package on Russia over its war against Ukraine, which includes a revised oil price cap and new banking restrictions.

EU member states gave the package the green light this morning after Slovakia lifted its veto.

Kaja Kallas, the EU’s High Representative for Foreign Affairs and Security Policy, says the sanctions package – the EU’s 18th – is one of the strongest put together against Russia so far.

It includes a ban on more Russian banks accessing the SWIFT international payments system, sanctions on the Nord Stream gas pipelines, and a lower cap on Russian oil sales.

We are standing firm.

The EU just approved one of its strongest sanctions package against Russia to date.

We’re cutting the Kremlin’s war budget further, going after 105 more shadow fleet ships, their enablers, and limiting Russian banks’ access to funding. (1/3)

Nord Stream pipelines will be banned.

A lower oil price cap.

We are putting more pressure on Russia’s military industry, Chinese banks that enables sanctions evasion, and blocking tech exports used in drones. (2/3)

For the first time, we're designating a flag registry and the biggest Rosneft refinery in India.

Our sanctions also hit those indoctrinating Ukrainian children.

We will keep raising the costs, so stopping the aggression becomes the only path forward for Moscow. (3/3)

Diplomat have told Reuters that the package will lower the G7’s price cap for crude oil to $47.6 per barrel.

Bloomberg reports that the new price cap, which is currently set at $60 per barrel, will now be set “dynamically” at $15 below market rates.

This follows criticism that Europe has been spending tens of billion on Russian energy since the Ukraine war began, exceeding the cost of it support for Kviv.

BP agrees to sell to sell US onshore wind business

Energy news: BP has continued its push to pivot back to oil and gas, by agreeing a deal to sell its US onshore wind business to LS Power.

The wind business operates nine onshore wind energy assets across seven US states, and are grid-connected and are providing power to customers.

William Lin, bp’s executive vice president for gas & low carbon energy, says:

“We have been clear that while low carbon energy has a role to play in a simpler, more focused bp, we will continue to rationalize and optimize our portfolio to generate value.

The onshore US wind business has great assets and fantastic people, but we have concluded we are no longer the best owners to take it forward.

The price of the deal hasn’t been revealed; BP says it is part of its $20bn divestment program to simplify and focus its business.

In the City of London, consumer goods maker Reckitt Benckiser has agreed to sell a majority stake in its Cillit Bang and Calgon arm to private equity firm Advent International.

The deal is worth up to £3.6bn, and will see Reckitt retain a 30% stake in the essential home business - also including brands such as Air Wick, Woolite, Resolve, Sole and Easy-Off

Kris Licht, Reckitt’s chief executive, says:

“We are executing our strategic plan at pace.

The divestment of Essential Home represents a significant step forward in unlocking the substantial value in our business.

This moves Reckitt towards becoming a simpler, more effective world-class consumer health and hygiene company and it will enable us to focus on a core portfolio of high-growth, high-margin powerbrands.”

Shares in Reckitt have risen 1.5% at the start of trading, putting it among the FTSE 100 top risers.

Katsunobu Kato’s criticism of US tariffs come after Japan’s exports to the United States fell for the third straight month.

Data released on Thursday showed that the value of shipments fell 11.4 percent in yen terms in June, compared with the same month last year.

The car sector was hit hard, with exports were down 26.7%. The number of vehicles was up, but their average price was down nearly 30%. That could be a sign that automakers are cutting prices or shipping cheaper models to offset the tariffs.

Japan’s Kato says tariffs not right tool to fix trade imbalances

Donald Trump’s trade war has loomed over the meeting of G20 finance ministers in South Africa this week.

Japan told the gathering of advanced economies in Durban that tariffs aren’t the right way to fix trade imbalances.

Finance minister Katsunobu Kato told reporters at the G20:

“Japan said that tariffs aren’t really the right tool to fix excessive current accounts imbalances.”

Kato argued that countries facing such situations need to address them through domestic efforts, rather than slapping new levies on imports.

The US’s trade balance (rarely the healthiest) has actually worsened this year, as American companies raced to import goods before tariffs were imposed.

However, US Treasury secretary Scott Bessent won’t have heard Kato’s message as he’s not attending the G20.

A finance ministry official accompanying Kato explained that many G20 members argued that market stresses appear to have eased somewhat, Bloomberg reports, as the world economy hasn’t suffered as much as expected from the trade war [although, of course, some of Trump’s new tariffs now don’t start until 1 August].

Introduction: China says 'win-win cooperation is the right path' as Nvidia H20 sales cleared

Good morning and welcome to our rolling coverage of business, the financial markets and the world economy.

Relations between the US and China appear to have warmed, slightly, after chipmaker Nvidia was given a green light by Washington to resume sales of its H20 AI chip to Chinese companies.

Nvidia’s CEO, Jensen Huang, revealed earlier this week that the US government has assured his company that licences for H20 chip sales to China would be granted, and that deliveries could start soon.

That reverses a restriction announced in April, when the White House announced tighter controls on exports of computer chips used for artificial intelligence.

And today, Beijing has welcomed this change of heart, confirming that the US has ‘taken initiatives” to approve H20 sales to China again.

China’s Commerce Ministry said in a statement that “win-win cooperation” was the right path to go down, and that it hopes the two countries can “meet each other half way” and work together.

The ministry also urged the US to abandon its “zero-sum mentality” and cancel ‘unreasonable’ trade restrictions on China, warning that “suppression” will not lead to solutions.

The H20 graphics processing unit, or GPU, is an advanced chip for use in AI systems. But it’s less powerful than Nvidia’s top semiconductors today, as it was designed to comply with US restrictions for exports of AI chips to China.

Earlier this week, commerce secretary Howard Lutnick revealed that the renewed sale of H20 chips to China was linked to a rare earths magnet deal. He also claimed Nvidia would only be selling China its “fourth best” chip.

Even so, the prospect of more sales to China pushed Nvidia’s shares to record highs this week.

Orders from Chinese companies for H20 chips need to be sent by Nvidia to the U.S. government for approval.

The agenda

-

9.30am BST: UK insolvency data

-

10am BST: Eurozone construction output data for May

-

1.30pm BST: US housing starts data for June

-

3pm BST: University of Michigan consumer confidence report

3 hours ago

3

3 hours ago

3