The maker of Wegovy and Ozempic, Novo Nordisk, has predicted a sharp drop in revenues this year owing to a push by Donald Trump to lower US weight-loss drug prices, rising competition and the loss of key patent protections.

Denmark’s Novo , once the poster-child for the growth in weight-loss treatments, said sales this year were likely to fall between 5% and 13%, despite the launch of its new Wegovy pill in the US. Its share price plummeted 18% on Wednesday morning, erasing all gains so far this year. In the past year the stock has lost nearly 50% of its value.

Last year, Novo sales grew by 10% to 309bn Danish kroner (£36.6bn) “despite being a challenging year for the company”, according to Mike Doustdar, the chief executive. Profit before tax rose by 3% to 130.5bn kroner.

Doustdar added that this year Novo expected to “face pricing headwinds in an increasingly competitive market”.

He pointed to Novo’s agreement with the Trump administration to heavily cut prices, from more than $1,000 a month to an average price of $350, and the patent expiry of semaglutide, the main ingredient of its obesity and diabetes drugs, in several countries, including India. That would allow generic drugmakers to make cheaper versions of Novo’s drugs.

Novo will, however, keep patent protection for semaglutide in Europe and Japan until 2033, and in the US until 2032.

Doustdar said: “We are very encouraged by the promising early uptake from the US launch of Wegovy pill, and we remain confident in our ability to drive volume growth over the coming years.”

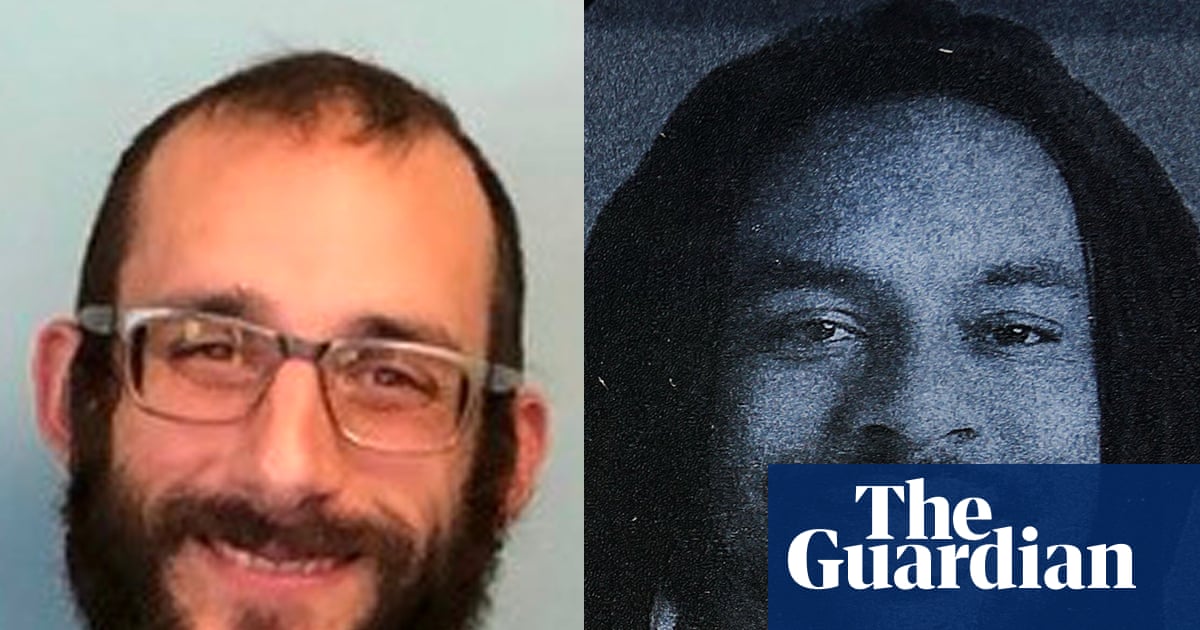

Doustdar succeeded Lars Fruergaard Jørgensen in August after Novo lost market share to its US rival Eli Lilly, prompting several profit downgrades. Doustdar quickly announced thousands of job cuts in an attempt to improve its financial performance.

Lilly’s Mounjaro jab leads to greater weight loss, clinical studies have shown.

The daily Wegovy pill, an oral version of Novo’s popular injection that users self-administer once a week, reached 50,000 US prescriptions a week by late January, after launching earlier that month.

It is the first GLP-1 tablet on the market, with Lilly expected to launch its own pill in the spring, subject to regulatory approval. The medications work by mimicking the gut hormone GLP-1, making patients feel fuller and limiting appetite.

The global GLP-1 market is expected to continue to expand, with Novo introducing new treatments, such as the Wegovy® pill and higher doses of Wegovy.

Darren Nathan, head of equity research at Hargreaves Lansdown, said: “Donald Trump’s crusade on drug prices, patent expiration, and competition all had their part to play. It wasn’t all bad news, with an extremely strong launch for the Wegovy pill, and a reminder of strong clinical progress in the next-generation pipeline at the tail-end of 2025.”

He added that Doustdar “faces some tough questions when he takes the podium in his first full-year earnings call later today, particularly if arch rival Eli Lilly’s results, due before Wall Street opens, paint a different picture”.

In London, Britain’s second-biggest drugmaker, GSK, said sales growth would slow to between 3% and 5% this year, from 7% growth to £32.7bn last year. In 2025, it initially had the same sales forecast as for this year, but upgraded it twice.

The forecast takes into account the company’s deal with the Trump administration to lower the cost of prescription medicines for American patients, in return for a tariff-free period of three years.

The company’s new chief executive, Luke Miels, who took over from Emma Walmsley at the start of the year, reiterated its £40bn-plus sales target by 2031. He said research and development would grow ahead of sales “as we continue to invest in the pipeline while driving operational efficiencies”.

GSK reported strong growth in speciality medicines, respiratory, immunology and inflammation treatments, cancer and HIV drugs last year. Oncology led the way with a 43% jump to £2bn. Vaccine sales increased 2% to £9.2bn, including its shingles, meningitis and RSV jabs.

Its share price dipped initially by 0.6% as trading began in London, before rising, up 2%, to the highest since July 2001.

Richard Hunter, head of markets at the trading platform interactive investor, said: “Given that GSK has 52% of its sales in the US, changes in pricing rules from the White House have inevitably had an impact.”

3 hours ago

3

3 hours ago

3