Introduction: US-China trade talks resume in London

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

Trade talks between the US and China are set to resume in London today, as officials push for a breakthrough over shipments of technology and rare earth elements.

After more than six hours of talks on Monday, negotations will resume at Lancaster House later this morning. Investors are hopeful of a breakthrough that could continue to ease tensions between the two economic superpowers.

President Donald Trump has indicated that the first day of talks were encouraging. He told reporters that “We are doing well with China. China’s not easy….I’m only getting good reports.”

The US are unhappy that China has not released crucial rare earth minerals, and magnets, as rapidly as hoped since the two countries agreed an initial trade pact in Geneva a month ago.

Treasury secretary Scott Bessent told reporters in London they had a “good meeting”, Bloomberg reports, while commerce secretary Howard Lutnick called the discussions “fruitful.”

The agenda

-

7am BST: UK labour market report

-

10.15am BST: FCA CEO Nikhil Rathi and FCA chair Ashley Adler testify to Treasury Committee

-

2.30pm BST: World Bank to release latest economic forecasts

Key events Show key events only Please turn on JavaScript to use this feature

Government borrowing costs are also dipping as bond prices rise, with traders calculating that today’s weak jobs report makes UK interest rate cuts more likely.

Pound drops after UK jobs report

Sterling is weakening on the foreign exchange markets, as investors digest the rise in UK unemployment and the drop in payrolls.

The pound has dropped by almost a cent against a generally stronger US dollar, to $1.346, its lowest level since the end of May.

The drop in the number of payrolled employees in the UK will help to “cement” an interest rate cut in August, argues ING Bank.

James Smith, ING’s developed markets economist, told clients this morning:

The cooling in the UK jobs market is gathering pace. Wage growth is slowing, too. While the bar for the Bank of England to speed up rate cuts seems to be set fairly high, this data helps cement cuts in August and November.

The UK jobs market might be turning a corner – and not in a good way. What stands out from the latest hiring numbers is a sharp 109,000 fall in payrolled employees in May. That is the largest monthly fall outside of the Covid-19 pandemic, since the data began in 2014.

However, there’s a fairly significant caveat, which is that this data has a habit of being revised up later on. Back in March, we saw a 78,000 fall, which was later revised up to a drop of 35,000. We’ll have to reserve full judgment until next month.

M&S website resumes online orders six weeks after cyber-attack

Sarah Butler

Marks & Spencer has reopened its website to shoppers, six weeks after it was forced to halt online orders after a cyber-attack.

The retailer said on its website that customers “can now place online orders with standard delivery to England, Scotland and Wales”. Deliveries to Northern Ireland “will resume in the coming weeks”.

“We will resume click and collect, next-day delivery, nominated-day delivery and international ordering in the coming weeks,” it said.

Wage growth slows

Wage growth slowed over the last quarter – which could be another sign of a weakening UK jobs market.

Average regular pay rose by 5.2%, in the February-April quarter, compared with a year earlier. That’s down from 5.8% in the previous quarter.

Annual growth in total pay (including bonuses), slowed to 5.3%, down from 5.7% in November-January.

Once you adjust for CPI inflation, regular pay growth slowed to 2.1% while total pay was up 2.3%.

Monica George Michail, associate economist at the NIESR economic research body, explains:

Annual regular wage growth remains strong at 5.2% in the three months to April 2025 amidst the rise in national minimum/living wage, according to today’s ONS figures. High service sector earnings growth is contributing to persistent core inflation, which continues to exceed 3%.

Unemployment continues to rise, which is expected to ease wage pressures moving forward. However, if wage inflation remains elevated in the coming months, there would be even less room for interest rate cuts by the Bank of England”.

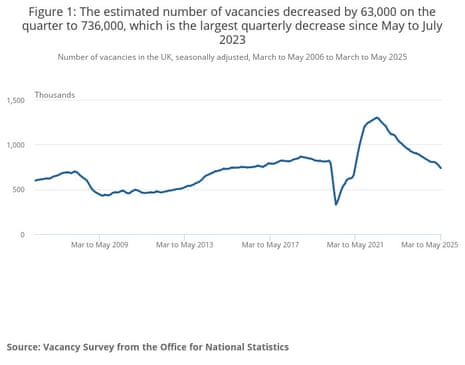

Vacancies fall

The number of vacancies across the UK has fallen, again, making it harder for unemployed people to find a new job.

Vacancies fell by 63,000 in the March-May quarter, to 736,000 – the 35th consecutive quarterly decline in a row.

There are now 150,000 fewer vacancies than a year ago – lifting the ratio of unemployed people per vacancy to 2.2 in February to April, up from 1.9 in the previous quarter.

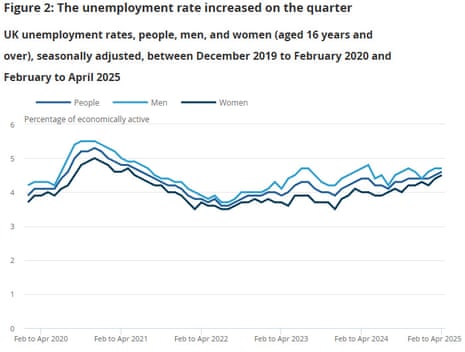

UK unemployment rate hits four-year high

Unemployment across the UK rose in the last quarter, today’s labour market data shows.

The UK unemployment rate rose to 4.6% in the February to April quarter, which is the highest rate recorded since the summer of 2021.

That’s a rise from 4.5% in January-March, and also up from 4.4% in the previous quarter.

But…. the employment rate has also risen, up 0.1 percentage point over the quarter to 75.1%.

How can employment and unemployment both go up? Because the number of people classed as economically inactive (neither in work, nor looking for a job) has dropped – pulling the UK economic inactivity rate down by 0.2 percentage points over the quarter to 21.3%.

UK payrolls fall 'notably' in May

Newsflash: The number of people on payrolls across the UK has fallen notably, in a sign that the jobs market is weakening.

The latest labour force statistics, just released, show that payrolled employment decreased by 109,000 employees (0.4%) in May, compared with April.

On an annual basis, there were 274,000 fewer employees last month, compared with May 2024, pulling total payrolls down to 30.2 million.

The Office for National Statistics does caution that these estimates are more uncertain than usual; if they’re accurate, though, it indicates that demand for workers at British firms is cooling.

The largest decrease was in the accommodation and food service activities sector, a fall of 124,000 employees in the last year, while health and social work added 62,000 employees.

ONS director of economic statistics Liz McKeown says:

“There continues to be weakening in the labour market, with the number of people on payroll falling notably. Feedback from our vacancies survey suggests some firms may be holding back from recruiting new workers or replacing people when they move on.

Introduction: US-China trade talks resume in London

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

Trade talks between the US and China are set to resume in London today, as officials push for a breakthrough over shipments of technology and rare earth elements.

After more than six hours of talks on Monday, negotations will resume at Lancaster House later this morning. Investors are hopeful of a breakthrough that could continue to ease tensions between the two economic superpowers.

President Donald Trump has indicated that the first day of talks were encouraging. He told reporters that “We are doing well with China. China’s not easy….I’m only getting good reports.”

The US are unhappy that China has not released crucial rare earth minerals, and magnets, as rapidly as hoped since the two countries agreed an initial trade pact in Geneva a month ago.

Treasury secretary Scott Bessent told reporters in London they had a “good meeting”, Bloomberg reports, while commerce secretary Howard Lutnick called the discussions “fruitful.”

The agenda

-

7am BST: UK labour market report

-

10.15am BST: FCA CEO Nikhil Rathi and FCA chair Ashley Adler testify to Treasury Committee

-

2.30pm BST: World Bank to release latest economic forecasts

22 hours ago

6

22 hours ago

6