Introduction: Tesla’s EU sales slumped in May despite EV market growth

Good morning, and welcome to our rolling coverage of business, the financial markets, and the world economy.

Tesla’s sales across Europe are continuing to slide, even as demand for electric cars rises.

The latest car sales data, just released, shows that Tesla sold 8,729 vehicles across the European Union last month, down from 14,682 in May 2024. That’s a 40.5% drop, which shrinks Tesla’s market share from 1.6% to 0.9%.

Tesla’s shares have been sliding across Europe through 2026, a decline blamed on CEO Elon Musk’s political activities, the company’s outdated model lineup, and competition from rivals such as China’s BYD.

Musk’s high-profile blow-up with president Trump, at the start of June, came too late to affect today’s data. Tesla will be hoping that its updated Model Y model, which was expected to roll out in Europe this month, can reverse the sales slump.

Overall, sales of electric cars rose by 25% last month – with 142,776 battery electric cars sold, up from 114,231 in May 2024.

ACEA, the industry body that collates the data, reports:

-

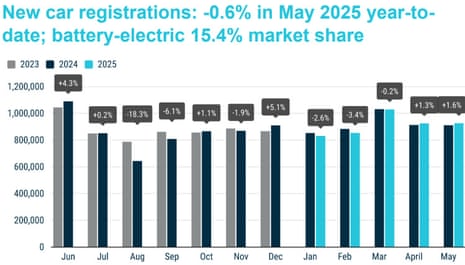

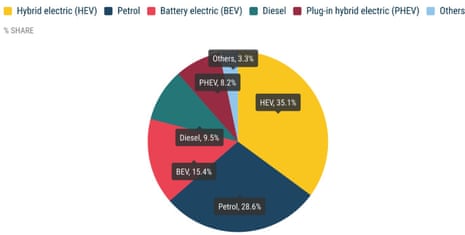

Up until May 2025, battery-electric cars accounted for 15.4% of the total EU market share, an increase from the low baseline of 12.1% in May 2024 YTD.

-

Hybrid-electric car registrations continue to surge, capturing 35.1% of the market, remaining the preferred choice among EU consumers.

-

Meanwhile, the combined market share of petrol and diesel cars fell to 38.1%, down from 48.5% over the same period in 2024.

The overall European car market grew by 1.6% in May, year on year, but is down 0.6% during 2025.

The agenda

-

10am BST: Treasury committee hearing on the spending review, with Darren Jones MP, Chief Secretary to the Treasury

-

Noon BST: US weekly mortgage approvals data

-

3pm BST: US new home sales data for May

-

3pm BST: Federal Reserve chair Jerome Powell’s second day of testimony to Congress

Key events Show key events only Please turn on JavaScript to use this feature

Shares in UK defence Babcock have surged 13% at the start of trading, after it upgraded its medium-term forecasts and hailed a ‘new era’ for defence (see earlier post).

Markets calm as Israel-Iran ceasefire holds

After several turbulent sessions, the financial markets seem calm this morning, as the Israel-Iran ceasefire holds.

London’s FTSE 100 share index has just opened 0.1% higher, up 10 points at 8768, despite reports that the US bombing of Iran’s nuclear facilities may only have set the nuclear program by a few months.

Germany’s DAX has risen 0.3% at the open, with France’s CAC gaining 0.16%.

Oil is slightly higher this morning, with Brent crude up 1.6% at $68.23 per barrel. That follows two days of heavy falls – down 7% on Monday, and 6% yesterday.

Susannah Streeter, head of money and markets at Hargreaves Lansdown, says:

‘’Optimism about the fragile ceasefire holding between Iran and Israel has bubbled through markets, lifting equities, but more doubts are now creeping in about the truce holding.

Wall Street rose in a relief wave, pushing the S&P 500 close to record highs. Sentiment has held up in Asia and European indices largely look set for a positive start to trading. Nevertheless, a little more uncertainty is seeping in. A leaked report from US Intelligence casting doubt on the effectiveness of the US strikes in crippling Tehran’s nuclear capabilities, has led to some worries that military action could resume.

Oil prices remain volatile with Brent Crude heading slightly higher on the speculation about hostilities breaking out again. It’s trading above $68 dollars a barrel, also gaining strength from industry data indicating supplies are tighter in the market.

Babcock profits surge in “new era of defence”

Lauren Almeida

Babcock, one of the biggest suppliers to the Ministry of Defence, has reported a 52% rise in pre-tax profit to £329m for its latest financial year, as its chief executive hails a “new era of defence” this morning.

David Lockwood, the boss of the FTSE 100 company, said:

“There is increasing recognition of the need to invest in defence capability and energy security, both to safeguard populations and to drive economic growth.”

Shares in Babcock have roughly doubled in value in the past year, as various governments have ramped up their commitments to defence spending in the wake of Russia’s invasion of Ukraine and conflict in the Middle East.

Babcock, which employs more than 26,000 people, is perhaps best known for managing Devonport, a naval dockyard in southwest England that is the largest of its kind in western Europe.

Revenue rose by 11% in its latest financial year, driven by strong growth in its nuclear and marine divisions. The nuclear business grew particularly strongly, with revenue up 19%. The company upgraded its guidance over the medium term, with an expected underlying profit margin now at 9%, up from previously forecast 8%. Babcock also announced it would buy back £200m worth of its own shares over the course of its current financial year.

Lockwood, who has led the business since 2020, noted that “a combination of continued global insecurity, rising global threats and rapidly evolving technology” had resulted in a stronger stance on defence and security by governments across its markets.

Babcock told the City:

“Nations are increasingly focused on securing national sovereignty and industrial resilience, prioritising equipment and infrastructure modernisation, evolving technologies and the need to work in partnership with industry.

These trends are likely to drive significant defence spending and increased investment in the civil nuclear sector for the foreseeable future.”

Here’s a chart showing the European car sales market so far this year

China's premier warns global trade tensions 'intensifying'

Chinese premier Li Qiang has warned today that global trade tensions are “intensifying”.

Speaking at the opening ceremony of the World Economic Forum’s Annual Meeting of the New Champions 2025 in Tianjin, Li said the global economy was “undergoing profound changes” – a nod to Donald Trump’s trade wars that have shaken the global economy this year.

Li told the event, dubbed the “Summer Davos”:

“Protectionist measures are significantly increasing and global economic and trade frictions are intensifying.

“The global economy is deeply integrated and no country can grow or prosper alone.”

“In times when the global economy faces difficulties, what we need is not the law of the jungle where the weak fall prey to the strong, but cooperation and mutual success for a win-win outcome.”

Speaking a few weeks after the US and China hammered out a new trade ‘framework’, Li also insisted China would “open its doors still wider to the world.

And, in a rebuff to criticism of the world’s current trading systems, Li insisted that economic globalisation will not be reversed, and will “only carve out a new path.”

Introduction: Tesla’s EU sales slumped in May despite EV market growth

Good morning, and welcome to our rolling coverage of business, the financial markets, and the world economy.

Tesla’s sales across Europe are continuing to slide, even as demand for electric cars rises.

The latest car sales data, just released, shows that Tesla sold 8,729 vehicles across the European Union last month, down from 14,682 in May 2024. That’s a 40.5% drop, which shrinks Tesla’s market share from 1.6% to 0.9%.

Tesla’s shares have been sliding across Europe through 2026, a decline blamed on CEO Elon Musk’s political activities, the company’s outdated model lineup, and competition from rivals such as China’s BYD.

Musk’s high-profile blow-up with president Trump, at the start of June, came too late to affect today’s data. Tesla will be hoping that its updated Model Y model, which was expected to roll out in Europe this month, can reverse the sales slump.

Overall, sales of electric cars rose by 25% last month – with 142,776 battery electric cars sold, up from 114,231 in May 2024.

ACEA, the industry body that collates the data, reports:

-

Up until May 2025, battery-electric cars accounted for 15.4% of the total EU market share, an increase from the low baseline of 12.1% in May 2024 YTD.

-

Hybrid-electric car registrations continue to surge, capturing 35.1% of the market, remaining the preferred choice among EU consumers.

-

Meanwhile, the combined market share of petrol and diesel cars fell to 38.1%, down from 48.5% over the same period in 2024.

The overall European car market grew by 1.6% in May, year on year, but is down 0.6% during 2025.

The agenda

-

10am BST: Treasury committee hearing on the spending review, with Darren Jones MP, Chief Secretary to the Treasury

-

Noon BST: US weekly mortgage approvals data

-

3pm BST: US new home sales data for May

-

3pm BST: Federal Reserve chair Jerome Powell’s second day of testimony to Congress

7 hours ago

2

7 hours ago

2