OECD cuts globa growth forecasts due to trade war slowdown

Newsflash: Global growth will slow this year as Donald Trump’s trade wars hit the world economy, a new report says.

The Organisation of Economic Cooperation and Development (OECD) has cut its forecasts for growth in 2025 and 2026, and warned that the global outlook is becoming “increasingly challenging”.

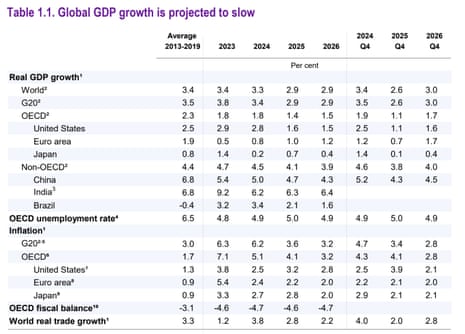

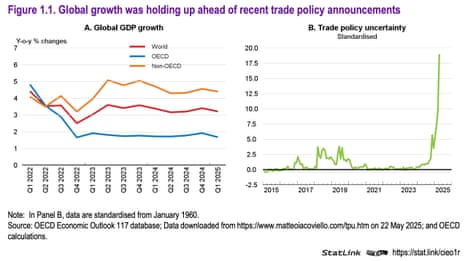

The OECD now predicts that global GDP growth will slow from 3.3% in 2024 to 2.9% this year and in 2026, “on the technical assumption that tariff rates as of mid-May are sustained despite ongoing legal challenges”.

In its latest global economic outlook, just released, the Paris-based thinktank explains:

The slowdown is concentrated in the United States, Canada and Mexico, with China and other economies expected to see smaller downward adjustments.

Back in March, the OECD had predicted that global GDP growth would slow to 3.1% in 2025, and then to 3.0% in 2026.

Today, it warns that global trade growth is likely to slow substantially over the next two years, after a burst of activity earlier this year as firms tried to stock up on goods ahead of tariff increases.

It says:

Substantial increases in barriers to trade, tighter financial conditions, weaker business and consumer confidence and heightened policy uncertainty will all have marked adverse effects on growth prospects if they persist.

Higher trade costs, especially in countries raising tariffs, will also push up inflation, although their impact will be offset partially by weaker commodity prices.

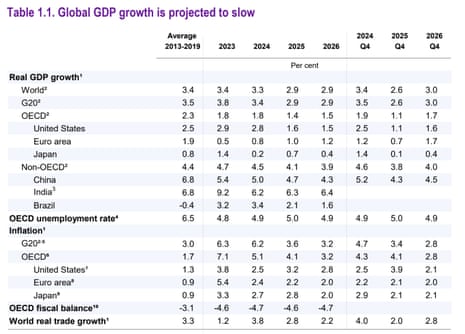

Here are the OECD’s latest growth forecasts:

Uncertainty is expected to hold back business investment, the OECD adds.

It fears that further increases or swift changes in trade barriers could intensify the growth slowdown and trigger significant disruptions in cross-border supply chains, and that the tariffs could push up inflation expectations, leading to higher interest rates and lower growth.

But on the upside, a reversal of the increase in trade barriers would support growth and reduce inflation, the OECD adds.

Key events Show key events only Please turn on JavaScript to use this feature

OECD: US effective tariff rate highest since 1938

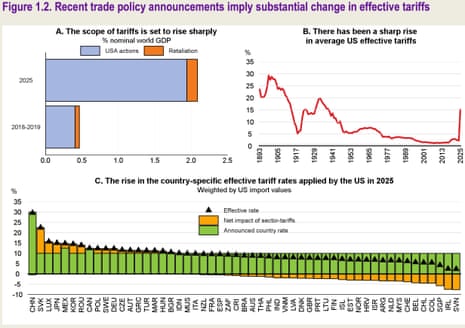

The OECD also show how the United States’s effective tariff rate had risen to 15.4% by mid-May, up from just over 2% in 2024.

That’s the highest rate since 1938, after the Great Depression, when the Smoot-Hawley Tariff Act had significantly raised tariffs on imported goods in the US, in a failed attempt to support domestic industry.

The OECD explain:

The US tariffs, together with retaliatory action by China, as well as more limited action by Canada, means that trade equivalent to over 2% of world GDP is now directly facing higher tariffs, pointing to much greater disruption than during the US-China trade tensions in 2018-19.

If current applied tariffs are sustained, effective tariff rates are likely to fall over time, as trade in more heavily-tariffed goods is likely to slow.

This chart, from the OECD’s new economic forecasts, show how trade policy uncertainty has surged this year:

OECD: US growth is expected to slow markedly

US economic growth is expected to slow markedly to 1.6% in 2025 and 1.5% in 2026, the OECD says.

That’s relatively weak growth by recent standard, and slower than the “robust” growth of 2.8% recorded in 2024.

The OECD says the slowdown is due to the “substantial increase” in the US effective tariff rate on imports, and the impact of retaliation from some trading partners.

It also cites “high economic policy uncertainty, a significant slowdown in net immigration, and a sizeable reduction in the federal workforce”, a nod to Donald Trump’s clampdown on workers entering the US and Elon Musk’s DOGE cost-cutting drive,

The OECD adds:

Annual headline inflation is set to pick up to 3.9% by end-2025 due to higher import prices but is expected to ease throughout 2026, aided by moderate GDP growth and higher unemployment.

Risks to the growth projection are skewed to the downside, including a more substantial slowing of economic activity in the face of policy uncertainty, greater-than-expected upward pressure on prices from tariff increases, and large financial market corrections.

Phillip Inman

The OECD has also cut its forecast for UK growth in 2025 and 2026, due to the damage caused by Donald Trump’s tariff war.

It has downgraded its expectations for this year and next from a forecast made in March; UK GDP growth is now projected to be 1.3% in 2025 before slowing to 1.0% in 2026.

Constraints on Whitehall spending and higher than expected inflation also played a part in a downgrade, the OECD said. More here:

OECD cuts globa growth forecasts due to trade war slowdown

Newsflash: Global growth will slow this year as Donald Trump’s trade wars hit the world economy, a new report says.

The Organisation of Economic Cooperation and Development (OECD) has cut its forecasts for growth in 2025 and 2026, and warned that the global outlook is becoming “increasingly challenging”.

The OECD now predicts that global GDP growth will slow from 3.3% in 2024 to 2.9% this year and in 2026, “on the technical assumption that tariff rates as of mid-May are sustained despite ongoing legal challenges”.

In its latest global economic outlook, just released, the Paris-based thinktank explains:

The slowdown is concentrated in the United States, Canada and Mexico, with China and other economies expected to see smaller downward adjustments.

Back in March, the OECD had predicted that global GDP growth would slow to 3.1% in 2025, and then to 3.0% in 2026.

Today, it warns that global trade growth is likely to slow substantially over the next two years, after a burst of activity earlier this year as firms tried to stock up on goods ahead of tariff increases.

It says:

Substantial increases in barriers to trade, tighter financial conditions, weaker business and consumer confidence and heightened policy uncertainty will all have marked adverse effects on growth prospects if they persist.

Higher trade costs, especially in countries raising tariffs, will also push up inflation, although their impact will be offset partially by weaker commodity prices.

Here are the OECD’s latest growth forecasts:

Uncertainty is expected to hold back business investment, the OECD adds.

It fears that further increases or swift changes in trade barriers could intensify the growth slowdown and trigger significant disruptions in cross-border supply chains, and that the tariffs could push up inflation expectations, leading to higher interest rates and lower growth.

But on the upside, a reversal of the increase in trade barriers would support growth and reduce inflation, the OECD adds.

Thames Water don’t disclose why KKR chose to walk away from talks to inject desperately needed fresh equity into the company.

Two weeks ago, Bloomberg reported that KKR’s proposal involved slashing about £8bn of Thames Water’s debt. The US investment group had been chosen by Thames to lead the company’s turnaround after it offered to put £4bn into the company.

Negotiations with regulator Ofwat had been expected to run throughout June, so today’s news that KKR have walked away is a surprise….

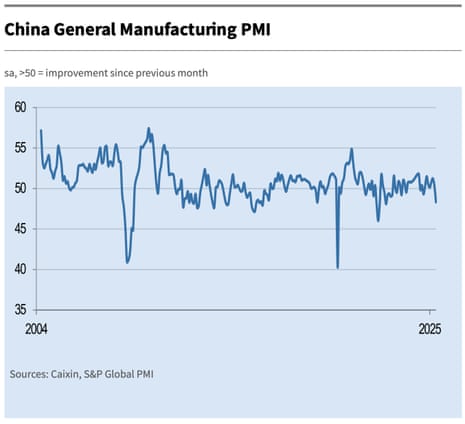

Analyst: China manufacturing slump is "canary in the trade war coal mine"

The slump in China’s manufacturing PMI (see opening post) is “a canary in the trade war coal mine,” says Stephen Innes, managing partner at SPI Asset Management.

The poor bird’s feathers have been “scorched by tariffs and global uncertainty”, Innes reports, explaining:

The Caixin Manufacturing PMI’s plunge to 48.3 isn’t just a weak print—it’s a body blow to the backbone of China’s economy: small and mid-sized exporters now caught in a brutal vice grip between faltering global demand and a Washington-led tariff regime that’s more carrot-and-stick diplomacy than ceasefire.

Water industry needs 'fundamental reset', report warns

Elsewhere in the water industry, a new report has warned that the water sector in England and Wales needs a “fundamental reset”.

In an interim report published on Tuesday, the Independent Water Commission says the water sector has been beset by “deep-rooted, systemic” failures.

The Commission says wide-ranging and fundamental change is needed in five areas – including clearer direction from government, stronger regulation of water companies, bringing decisions on water systems closer to local communities, and greater focus on responsible, long-term investors.

The report also singles out regulation, saying that Ofwat needs to embrace a “supervisory approach”, so it can intervene early before problems arise. The current model relies heavily on ‘comparability’ – benchmarking companies against one another to assess efficiency and justify customer bills, the Commission says.

Independent Water Commission chairman Sir Jon Cunliffe said he had heard a “strong and powerful consensus” that the system was not working for everyone.

Cunliffe:

“There is no simple, single change, no matter how radical, that will deliver the fundamental reset that is needed for the water sector.”

“We have heard of deep-rooted, systemic and interlocking failures over the years – failure in Government’s strategy and planning for the future, failure in regulation to protect both the billpayer and the environment and failure by some water companies and their owners to act in the public, as well as their private, interest.

“My view is that all of these issues need to be tackled to rebuild public trust and make the system fit for the future. We anticipate that this will require new legislation.”

KKR pulls out of a deal to inject fresh equity into Thames Water

Newsflash: Thames Water’s efforts to avoid nationalisation have taken a blow.

US investment firm KKR has walked away from the chance to take a stake in the troubled water utility, putting its future in fresh doubt.

Thames had selected KKR as a “preferred partner” at the end of March, as it looked for a partner to take a stake in its business.

But today, Thames told the City that KKR has indicated that it will not be in a position to proceed, and its preferred partner status has now lapsed.

Sir Adrian Montague, Chairman of Thames Water, says:

“Whilst today’s news is disappointing, we continue to believe that a sustainable recapitalisation of the Company is in the best interests of all stakeholders and continue to work with our creditors and stakeholders to achieve that goal.

The Company will therefore progress discussions on the senior creditors’ plan with Ofwat and other stakeholders. The Board would like to thank the senior creditors for their continuing support.”

Thames, which is struggling under a debt pile of close to £20bn, also says that “certain senior creditors” have been working on alternative transaction structures to seek to recapitalise the business. It will now “progress discussions on the senior creditors’ plan with Ofwat and other stakeholders,” it says.

Significant announcement from troubled Thames Water. Its preferred equity partner KKR has pulled out of plans to invest billions the company requires to survive. "KKR has indicated that it will not be in a position to proceed". https://t.co/SdT7bfZgpb

— Paul Kelso (@pkelso) June 3, 2025If a deal can’t be reached, and Thames falls into bankruptcy, then the company could be takenn into a special administration regime by the UK government.

Introduction: China’s May factory activity shrinks as tariffs hit demand

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

Evidence is mounting that Donald Trump’s trade war is disrupting manufacturing activity around the globe.

China’s manufacturing activity in May shrank at its fastest pace in two and a half years, according to the latest survey data, as firms were hit by a fall in new orders, and weaker export demand.

The Caixin/S&P Global manufacturing purchasing managers’ index, released this mornng, fell to 48.3 in May, down from 50.4 in April. Any reading below 50 shows a contraction, and this is the lowest reading since September 2022.

During April, the US and China imposed tit-for-tat tariffs on each others exports, resulting in triple-digit levies, before the two sides reached a deal on 12 May to lower those tariffs to 10% for 90 days.

Today’s PMI report indicates the Trump trade war hurt demand.

Dr. Wang Zhe, senior economist at Caixin Insight Group, explains:

“Overall, in May, manufacturing supply and demand declined, dragged by overseas demand. Employment continued to shrink, while prices remained weak. Logistics were delayed moderately, with manufacturing stocks remaining stable. Business optimism recovered slightly from April’s low.

“Currently, unfavorable factors affecting China’s economic development remain relatively prevalent. Uncertainty in the external trade environment has increased, adding to domestic economic headwinds

“Major macroeconomic indicators showed a marked weakening at the start of the second quarter. The downward pressure on the economy has significantly intensified compared to preceding periods.

Yesterday, a survey of US factories also showed a drop in production last month, with several manufacturers blaming tariffs for pushing up prices and hitting demand.

That helped to push the US dollar close to a three-year low against a basket of other currenciess.

The agenda

-

8am BST: OECD begins Ministerial Council Meeting in Paris

-

8am BST: OECD to release latest global economic outlook

-

10am BST: Eurozone inflation flash reading for May,

-

10.15am BST: UK Treasury committee hold hearing with Bank of England policymakers

1 day ago

22

1 day ago

22